When you’re trying to figure out how to pay for study abroad, you have lots of questions. How much will it cost? How do I get a scholarship to study abroad?

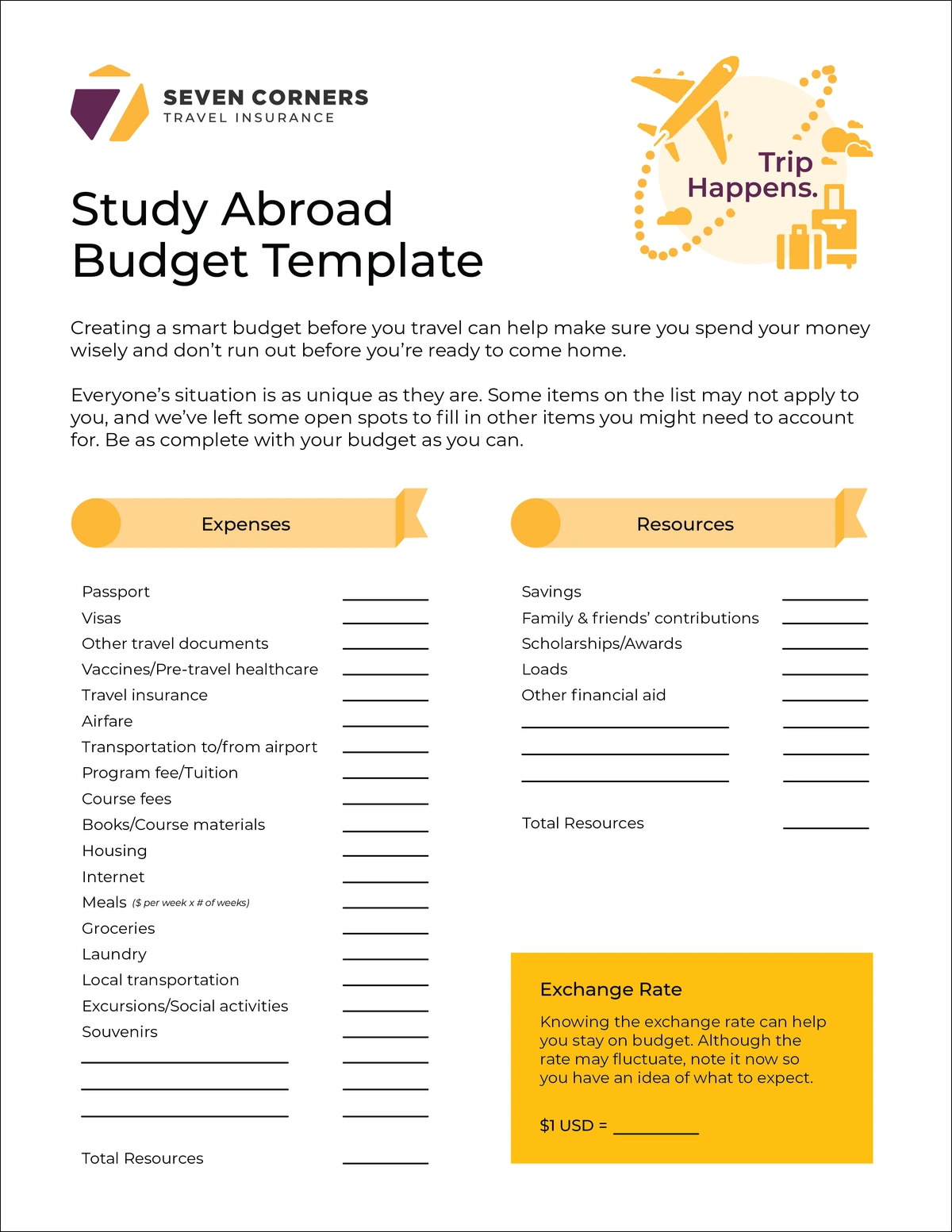

Whether you’re a student hoping to take a semester abroad or the parent of a budding globetrotter, you need a budget to make the dream a reality. You’re in luck because these four tips — plus our handy study abroad budget template — can help.

1. Study Abroad Budgeting 101

If you don’t already have a personal budget for everyday expenses, now’s the perfect time to start. You can use an app or a spreadsheet or a simple notebook and pencil. Whatever your method of choice, write down all the money you have coming in each month — paychecks, stipends, and so on — and how much you have going out — rent, groceries, school expenses, “go out and have fun” money, and bills.

That resulting document should give you a clear snapshot of the kind of money you have to work with. And once you have that information, you’re halfway to knowing how much money you need to study abroad.

Your next step should be a little easier if you’ve already decided on where to study abroad. Log the expenses you’ll need for your trip. First include everything you’ll need to pay before you travel: processing fees for a passport, visa, and other travel documents; payment for vaccines and other pre-travel healthcare; travel insurance; tuition, registration, and course fees; airfare to and from your destination.

Next include all your anticipated expenses you’ll pay during your trip: transportation to and from the airport, books or printing fees, housing, meals, transportation around your host city and on excursions, souvenirs, groceries (including hygiene items and the like as well as food), laundry, internet.

Add all of those expenses and you should have a pretty complete picture of how much it will cost you to study abroad. Compare that with your everyday budget (we bet accounting majors are loving this exercise).

Now you know if you have the funds for your international trip, or if you need to start the search for study abroad scholarships and other funding.

2. How to Pay for Studying Abroad

These are some of the most common places to find extra money for studying abroad.

Family and friends

We know it can be awkward to ask family and friends for money. Sometimes the people you already know are the most likely to chip in toward your adventure, though.

If it helps, think of it as pitching a business opportunity to potential investors. You’re asking them to invest in your future, much the same way entrepreneurs ask Shark Tank to invest in their start-up company.

Scholarships

Study abroad scholarships are great because they’re essentially free money. You have to put in some time and effort during the application process, but it’s a small sacrifice given the potential payoff.

Many scholarships to study abroad are merit-based, while others are sponsored by businesses. Some might require you to be of a certain nationality or want you to study in a certain country, but others will be more open.

A bit of online sleuthing could uncover more opportunities than you realize. Start on a site like International Student and branch out from there.

There’s no secret to how to get a scholarship to study abroad. When in doubt, apply. Thousands of scholarships go unawarded every year because no one applies for them. This happens especially with smaller awards.

Your local Kiwanis Club might offer a relatively small $500 scholarship, but the competition for it could be low. Besides, money is money. A couple hundred dollars here and a few more hundred there adds up. Two $500 awards could cover your entire airfare, after all.

Don’t leave money on the table because you assumed your grades aren’t good enough or it might not be worth it. Go out and get what you deserve!

Loans

Much the same way you might be taking out loans to pay for college at home, you can use loans to bankroll your study abroad experience.

If you do take out a loan, pay attention to repayment terms and interest rates. At some point, you’ll need to give that money back. As amazing as any trip is, it might not be worth digging a deep financial hole. Rely sparingly on loans.

3. Understanding Currency and Exchange Rates

Now that you have your budget and are closer to studying abroad, take some time to get familiar with some international banking concepts (it’s not as dull as you think).

What is the exchange rate?

In simple words, an exchange rate tells you how much of your currency it costs to buy another currency. That cost can fluctuate over time based on the economy, market supply and demand, and more (go ask an econ major for more details).

Not knowing the exchange rate for your currency versus your destination’s could mean you run out of money before your trip ends.

Here are two great examples to see the exchange rate in action.

When we last checked, one Swiss Franc (CHF) equaled $1.18 USD. That means that if I buy a coffee and a croissant for 8.52 CHF, it’s the same as paying $10, not $8.52.

In a sense, it’s more expensive than the receipt makes it seem. This is when you’ll hear people say, “It’s not a favorable exchange rate,” or “The USD/Franc exchange rate is bad” (at least from the American perspective).

Alternatively, when we checked, one Mexican peso equaled $0.06 USD. If I buy sopapillas to snack on and they charge me 85 pesos, it’s the same as me paying about $5 USD. That’s a “favorable” exchange rate for me.

To find the real-time exchange rate of any currency, you can simply Google “exchange rate US dollars to ...” You could also bookmark an exchange rate calculator on your phone. This Xe currency converter not only shows you what the rate is now, but you can see how it has changed over time.

Will there be international fees for banking?

You’ll want to check with your personal bank and each credit card company about what, if any, fees they charge for international transactions. In our experience, most do charge a fee and they do so with every single credit card purchase, ATM withdrawal, or bank transaction.

An international transaction fee could be a percentage of the purchase price or transaction itself, or it could be a flat rate. Be sure you understand your financial institution’s policy and keep it in mind during your trip so you don’t pay more fees than you need to.

Do I need a bank account at my destination?

Most students going abroad won’t need an international bank account; in fact, some countries make it very difficult for a non-resident to even get one. You likely won’t need an account unless you’ll be overseas for a year or more, which is more common during graduate and post-graduate studies.

The university you’re studying with will tell you if you need a local bank.

How much money do I need to convert?

If you want to convert a bit of money to your destination’s currency before you leave home, that’s an option. Some people feel more comfortable knowing they already have a bit of cash on hand when they land in case they need to buy something sooner rather than later.

Just be aware that banks can charge higher fees for exchanging money and they might not have the best exchange rate. You’ll probably get a better rate once you land at your destination.

How much you choose to convert at one time depends on your spending habits and, to some extent, where you’re traveling. Even so, we recommend not exchanging all your money at one time.

Exchange rates fluctuate over time. Obviously, the rate could become less favorable, but it could also get better. Especially for longer trips, exchanging some money right away and more later isn’t a bad gamble to take.

Not having too much money on hand can be safer for your budget. First, if you don’t have it readily available, you’re less likely to spend it. You'll think a little harder about a tempting impulse purchase if you have to exchange money to get it first.

Second, having less cash in your pocket or luggage reduces the damage if you get pickpocketed. They might take everything, but if you only have $30 in your wallet, that’s better than losing $1,000 if you exchanged all your money at once.

4. Immerse Yourself Wisely.

You’re really doing it! Your smart financial decisions mean you’re able to take that study abroad trip. Now keep making those smart choices.

Stick to your budget from Step 1.

You might find yourself wanting to explore your new country or hopping a train every weekend to cross another destination off your bucket list. Don’t let us stop you. And don’t let running out of money stop you, either. Make sure you’re sticking to the budget you made before you left home so you can continue to afford racking up the experiences.

How do you stick to your budget? Use your financial app or notebook to track your expenses and income during your trip. Knowing is half the battle, and if you don’t know what you’re spending and how, you’re going to blow your budget.

Also, learn to say no. You’re going to make great new friends who will ask you to go out to eat or hang out at the pub with them. They’ll encourage you to take a spontaneous trip to the beach. Do it ... sometimes. Say no other times to keep a smart handle on your finances.

Find ways to travel cheaply.

First, make local friends. If your classes are integrated with native students, you have a built-in social network waiting for you. Take advantage of it. These locals can take you off the typical tourist path where food, goods, and activities are not only the real deal, but also tend to be less expensive.

Second, take advantage of student discounts. Many attractions, museums and theaters, public transportation, restaurants, and hostels offer lower prices if you can show a student ID. If your international school doesn’t provide a student ID, bring the card from your home institution. It might still be accepted.

Finally, even though we said to practicing saying no, take advantage of your location. The weekend train from Madrid to Seville is a lot cheaper than a flight from Minneapolis to Seville if you wait to visit after you’ve returned home. Make the most of your time and your money while you're within reach.

Budget for the Unexpected.

Even the best study abroad plan can’t account for everything. A can’t-miss opportunity to explore the next town over will pop up. You’ll discover a passion you never knew you had and decide to change your major. You’ll get sick during your trip.

While you can’t anticipate the exact moment and situation that things will go off the rails, you can know how you’ll react. One of the best ways to prepare for the unexpected is with travel insurance.

Many study abroad programs have travel insurance requirements. These are designed to keep you safe during your trip. If you get sick or hurt, you don’t want to be wondering how (and if) you’ll be able to pay for medical care. Even countries with universal healthcare aren’t obliged to treat an international visitor for free.

Choosing the right travel insurance coverage — ideally with medical benefits as well as trip protection benefits so you can recover your money if you need to cancel your trip or return home early — can end up saving you financially.

If you aren’t sure what you need, contact our agents by phone or email. You can also answer a few simple questions on our website, and we’ll point you toward the best coverage for your study abroad adventure.

Travel Like a Pro with The Wayfinder

Did you enjoy this blog? Get more articles like it before anyone else when you subscribe to our monthly newsletter, The Wayfinder.