When you buy a flight, you generally know what you’re getting: a seat, transport from Point A to Point B, maybe a tiny bag of pretzels.

Booking a ticket isn’t something you usually stress too much about. At least not until you find out there was a bunch of fine print you missed, like explanations of extra baggage fees or not being able to choose a seat next to your partner.

Buying travel insurance can be a similar experience. On some level, you know that when you buy travel medical insurance, you’re getting protection for when you get sick or hurt on your trip.

But like those unexpected upcharges for baggage, you can find yourself less prepared than you thought if you don’t fully understand the insurance you bought.

We don’t want anyone to feel tricked or shortchanged. That’s why we’re sharing some of the important terms you should know when buying travel insurance.

The better educated you can be, the less likely you are to be surprised by your coverage or an exclusion later. And the more likely you are to make sure you choose the right coverage from the start.

After you’ve gotten the hang of the basic definitions below, check out our guide for how to read an insurance policy. Now let’s get started.

Travel Insurance Terms: The Basics

We’ve broken some of the most important travel insurance terms down into three categories. We’ll start with some of the basics, some foundational terms that get to the heart of what travel medical insurance is and what it can do, and then get into some key terms about money and timing.

1. Travel Medical Insurance

Travel medical insurance is a type of insurance that combines medical expense protection and 24/7 non-insurance emergency travel assistance services to protect you when you travel outside of your home country.

This is different from trip protection or trip cancellation. Learn more about what travel medical insurance can provide and why it’s worth the investment.

2. Benefits

Benefits include any expenses that are covered by your insurance. Examples of benefits in Seven Corners Travel Medical Insurance and Seven Corners Travel Medical Global can include hospital room and board, trip interruption, and emergency medical evacuation and repatriation.

Just because something is listed as a benefit doesn’t mean it’s automatically covered. There could be an exclusion that applies.

It’s a good idea to be familiar with all the benefits and exclusions in your plan document. You don't want to be surprised if a claim is denied because it wasn’t a covered benefit. For example, treatment you receive from a relative or immediate family member is not covered.

If something in the plan document is unclear to you, contact our agents or a customer service representative. They’re here specifically to help you understand what you’re buying.

3. Schedule of Benefits

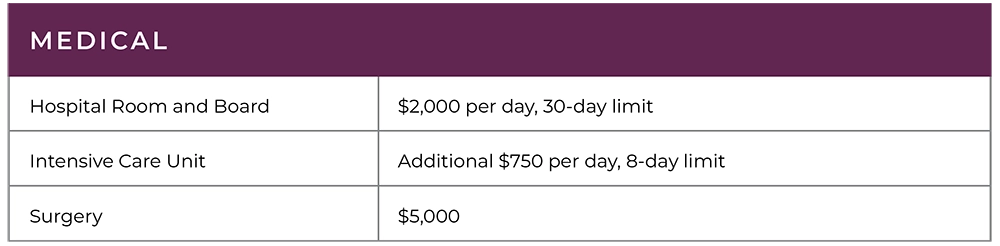

You’ll find a schedule of benefits in your plan document. This chart (it’s usually a chart) shows a summary of the plan’s benefits and their coverage amounts.

Some plans provide benefits that are covered up to a certain amount, while others have a dollar amount as a limit for each kind of service in addition to a larger, overall limit. It might look something like this chart.

The schedule of benefits helps you know how much your travel insurance provider will pay and how much, if anything, you can expect to pay if you have to seek medical treatment during your trip.

4. Claim

A claim is a request for reimbursement — to you or your medical provider — due to a loss. You or your provider may file a claim for any service you receive, and we’ll review that claim and let you know what is payable.

If your claim is denied and you believe there is information we haven’t reviewed that would help prove your claim is payable, you can file an appeal. This is simply a letter explaining why the claim should be paid and some type of relevant document, perhaps from a provider, that supports the appeal.

5. PPO/Provider Network

First, a provider, or service provider, is another word for a medical doctor, facility, or company that provides medical services.

A Preferred Provider Organization (PPO) or Provider Network is a group of providers that are contracted with us. If your Seven Corners plan uses a PPO, providers you find within the PPO network will accept the insurance and bill us directly.

Some plans have no provider network. Check your ID card or give us a call if you’re not sure whether there is a PPO for your plan.

Seven Corners provides a PPO network in the United States for some of our plans. Outside of the United States, we maintain a directory of reputable providers.

6. Primary vs. Secondary Insurance

Your primary health insurance in your home country is designed to be the first payor of claims in most cases. Seven Corners has some plans with primary coverage, but travel insurance is often a secondary payor of claims. This means that if your primary insurer does not pay for all expenses on a claim, travel insurance with secondary coverage will review what your primary insurer paid and then pay some or all of the remaining eligible expenses.

For example, let's say you received hospital treatment that cost $10,000. Your primary health insurance from your home country agrees to pay $6,000 of that expense. Seven Corners will then evaluate the claim to pay for some or all of the remaining $4,000.

Travel Insurance Terms: Money

One of the advantages of buying travel medical insurance is protecting your money if you need emergency medical care while traveling. Treatment can get expensive, and your domestic health insurance typically will not cover you in another country. Below are some of the key finance-related terms you need to understand when reading a plan document.

1. Coinsurance

Coinsurance is a payment you share with the insurance company. There is a percentage of costs that you’re responsible for, and a percentage that the insurance company will pay for eligible benefits.

An example of coinsurance found in a typical travel insurance plan is 80/20 coinsurance for the first $10,000 in covered expenses, then 100% to the medical maximum.

This means if your covered medical expenses totaled $20,000 after your deductible, the insurance company would pay a total of $18,000, and you would pay $2,000.

The insurance company pays:

$8,000 (80% of the first $10,000 in expenses) + $10,000 (100% of the remaining $10,000) = $18,000

You pay:

$2,000 (20% of the first $10,000 in expenses)

If your plan doesn’t mention any coinsurance, it means that the plan pays 100% after you pay your deductible and copays.

2. Copayment

This is the amount of money you pay for each visit — upfront — for a certain type of treatment.

For example, Seven Corners Travel Medical plan has copays in the USA for emergency room and urgent care treatment as well as physician office visits. You must pay the copay at the time you receive treatment, and copays typically do not count toward the deductible.

Seven Corners Travel Medical Global and Seven Corners Travel Medical Excluding the USA do not have copays.

3. Deductible

A deductible is the amount you pay before the insurance company pays on your claim. You’ll be responsible for that amount, and then the insurance pays whatever is left over (after coinsurance if there is any).

You select a deductible when you buy a plan. Options for some of Seven Corners' travel medical plans range from $0 to $5,000.

A higher deductible will lower your premium because you’ll be responsible for absorbing more of the cost of your claim. Essentially, you’re taking on more of the risk. You’ll pay less for your insurance because you will pay more when you make a claim, due to the higher deductible.

A lower deductible, on the other hand, will increase your premium because you’ll pay less toward your claim in the future, if you make one.

Check your plan to see if you have a deductible that only applies once during your coverage period or one that applies for each new illness or injury. This way you’ll know what to expect for your out-of-pocket expenses.

4. Medical Maximum

Medical maximum is the amount the insurance company pays for a covered sickness or injury that occurs while you’re covered by the plan.

Think of it as a giant bucket, and medical expenses like hospital room and board, emergency room expenses, doctor office visits, and prescription drugs are paid from that bucket. If your expenses total more than your medical maximum — using up everything in your bucket — the remaining expenses above the medical maximum are not covered and are your responsibility.

Medical maximum options for Seven Corners' travel medical plans range from $10,000 to $1,000,000, depending on the plan you choose and your age.

The lower your medical maximum, the lower your premium. Likewise, the higher your medical maximum, the higher your premium.

5. Premium

Insurance premium is simply the cost or price of your insurance, and it varies depending on the length of your trip, the deductible and medical maximum you choose, and whether you add optional benefits.

Travel Insurance Terms: Time

Do you know when you should buy travel medical insurance? What about knowing when your coverage starts? The answers to these questions will be clearer when you understand the terms below.

1. Period of Coverage

Your period of coverage is the length of time — running from your effective date to the expiration date — you have coverage under your plan.

Coverage for travel medical insurance begins at 12 a.m. United States Eastern Time the day after Seven Corners receives your premium payment but not before you depart your home country, regardless of when you buy it.

Your expiration date is typically when you arrive back in your home country, although you should review your plan document for more details as there are exclusions and other instances when that might not be the case.

Seven Corners Travel Medical Insurance and Travel Medical Global can cover you for as little as five days, up to 364 days.

Some plans allow you to renew your coverage, but there may be the stipulation that you renew before your current plan expires. This is one reason it’s important to know your period of coverage and coverage expiration date.

2. Benefit Period

This is different from period of coverage. Your benefit period is the time you have to complete treatment. In most plans, this is 180 days from the date of your injury or onset of illness. Your first treatment also must be within the first 30 days.

Here’s an example. Let’s say I’m on a year-long European tour. On March 1, I hurt my knee in France. In order to be covered, I must visit the doctor by March 30. If my plan’s benefit period is 180 days, any subsequent treatment after that initial visit must happen by August 28.

The length of your benefit period can vary by plan (some plans don't have a benefit period at all), so be sure to check your plan document for details.

3. Date of Service

The date of service is when you received medical treatment. Claims must be submitted within 90 days of the date of service. That 90 days begins when you first receive treatment for an illness or accidental bodily injury.

4. Timely Filing

Timely filing is the official term for the deadline to file a claim. Most plans have a timely filing limit of 90 days, meaning you must submit the claim within 90 days of when the incident occurred. You can find this deadline in your plan document.

Even with a 90-day filing limit, it’s a good idea to submit a claim as soon as possible. You don’t want to miss out on being reimbursed simply because you missed the deadline.

What's Next?

This list of travel insurance terms merely scratches the surface of what you’ll find in your plan document. Admittedly, it can be frustrating to read through that document, trying to make heads or tails of all the official language.

The licensed travel insurance agents at Seven Corners can help, though. Contact us with any questions before or even after you purchase your plan so that you fully understand what your insurance covers.

And if you haven’t decided yet on the best insurance for your next trip, we can help with that, too.