Key Differences between Visitor Travel Insurance Plans

Angela Borden | Jun 13, 2023

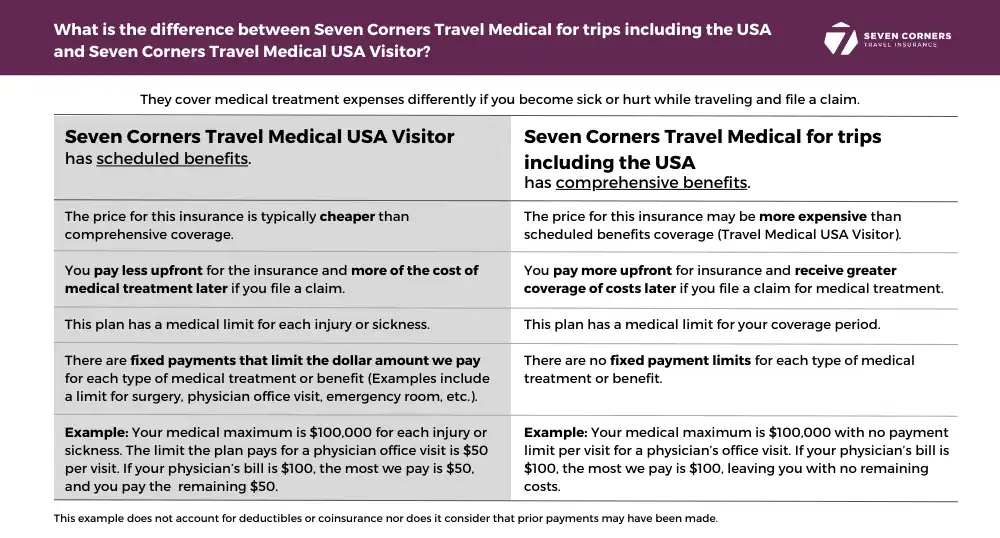

If you live outside the United States, you’re not a U.S. resident or citizen, and you’re planning a trip to the USA, Seven Corners offers two types of travel medical insurance for you. The biggest difference between them is how benefits for medical treatment are paid — with comprehensive coverage or with scheduled benefits — if you become sick or hurt while traveling. This is important because it affects the price you'll pay for your plan and the level of coverage you receive.

One type of plan, Seven Corners Travel Medical, provides comprehensive coverage. The other, Seven Corners Travel Medical USA Visitor, provides scheduled benefits coverage.

This comparison chart offers a quick summary of the differences between the two plans. Keep reading for more details on each.

Ready for more?

Learn more about Seven Corners Travel Medical Insurance. →

Learn more about Seven Corners Travel Medical USA Visitor. →

Seven Corners Travel Medical Insurance Plans Have Comprehensive Benefits.

Plans with comprehensive benefits are the most common type of travel medical insurance, and you can customize your coverage by choosing your medical maximum and deductible. The medical maximums range from as low as $10,000 up to $1,000,000. For deductibles, you can choose one as low as $0 and as high as $5,000.

The price of the plan is based on your age as well as the medical maximum and deductible. Higher medical maximums are more expensive as are lower deductibles.

Coinsurance applies after you pay your deductible, and it is based on the plan level you select and where you seek treatment. For example, if you seek treatment in the PPO network in the USA, coinsurance is 100%. This means the plan pays 100% of covered medical expenses, and you pay $0.

If you seek treatment in the USA outside of the PPO network, coinsurance will apply according to the stated percentage. For example, the plan may state: “We pay 80% of the first $10,000 in covered expenses, then 100% to the medical maximum.” This means if your covered expenses were $20,000, based on your portion of coinsurance, you pay $2,000 (20% of the first $10,000 in covered expenses). The plan pays $18,000.

For medical treatment in the United States, the Seven Corners Travel Medical plans utilize the UnitedHealthcare network.

Who can buy a Seven Corners Travel Medical plan?

Seven Corners Travel Medical Insurance is available to U.S. citizens as well as non-U.S. citizens and residents traveling outside their home country. U.S. citizens, even those living outside of the United States, cannot buy this plan for travel to the United States and U.S. territories.

Seven Corners Travel Medical USA Visitor Plans Have Scheduled Benefits.

Scheduled benefit plans are often less expensive than a comprehensive plan. However, while their upfront cost can be MORE affordable, they do not provide as much coverage when you make a claim.

For these plans, like those with comprehensive coverage, you also choose a medical maximum and deductible. The real difference exists in the way the plan pays. It provides stated coverage limits for each type of medical treatment covered by the plan.

For example, in the Basic plan option, you may see surgery covered up to $3,000. This is the limit we pay after you’ve met your deductible. You are responsible for paying any charges over the $3,000 limit. The plan document and the Travel Medical USA Visitor product page show all the limits for the different types of medical treatment.

Who can buy a Travel Medical USA Visitor plan?

Seven Corners Travel Medical USA Visitor insurance is a visitor plan designed specifically for non-U.S. citizens and non-U.S. residents who are traveling outside their home (resident) country to visit the USA.

This plan does not provide coverage through a PPO network. Our Seven Corners Assist team can help you find a medical facility if you choose this plan.

Choose the Best Travel Medical Insurance for Your Next Trip.

Now that you know the basic information regarding coverage for both types of travel medical plans for visitors to the USA, you can review pricing and options and decide which plan you need.

If you’re looking for a less expensive plan that pays set amounts for each type of medical treatment, you may choose Travel Medical USA Visitor, our scheduled benefits plan. If you’re looking for more coverage, you may select a comprehensive benefits plan, like Seven Corners Travel Medical. Each plan can be tailored to fit your needs, and you can get a quote quickly and easily.

If you decide to buy a plan, the purchase process takes just a few minutes. We don’t ask any health questions, and coverage begins at 12 a.m. the day after you purchase.* You’ll receive confirmation of your purchase and your plan documents immediately by email.

Ready to purchase your plan?

As always, Seven Corners is here to help! If you need details or have questions about purchasing a plan, contact one of our licensed sales agents by chat or call 1-800-335-0611.

*United States Eastern Time

Search Posts

Receive our monthly inspiration and travel tips from the travel insurance experts.

Sign me upThis website and various social media updates provided by Seven Corners contain content, information, articles, videos, and links to websites created by third parties. Seven Corners, its owners, and its employees neither endorse nor are responsible for the accuracy, timeliness, or reliability of any third-party information, statements, opinions, or advice and are not liable for any loss, harm, or damage caused by your reliance upon them. Use of such information or the linked websites is entirely at your risk. Concerns regarding this third-party content should be directed to the third party. Seek professional advice, as appropriate, regarding your use of such information and websites.

Because the information on this website and in Seven Corners’ blogs and other social media is written and compiled using knowledge and information available at a certain point in time, it may become outdated. For that reason, information, events, legal requirements, and product changes (including benefits, limitations, exclusions, and services) may not be up-to-date, complete, or accurate at the point in time it is being read. Again, use of such information is at your risk.